Personal receivership: a “powerful tool” of lenders

In New Zealand, receivership is one of the formal insolvency processes used alongside liquidation and voluntary administration. When a company struggles with its debt, receivership can be a secured creditor’s solution to recovering funds.

However, receivership applies to more than just companies. Lenders can also appoint receivers over individual’s property if financial payments are not met, and the borrower is technically in financial default.

The receiver’s role is to take control over the property and sell the assets to repay outstanding debts to creditors. For companies, this includes physical assets (motor vehicles, tools, plant, equipment), accounts receivable, cash and contracts. For individuals, it could include, but is not limited to, real estate, bank accounts, vehicles, jewellery, and even a mustang residing in a stable of the estate.

Personal receivership is less common than company receivership and usually occurs when an individual has provided personal guarantees for business debts or has significant secured liabilities.

Most of the time, lenders appoint receivers under a General Security Agreement (GSA), which allows them to recover money owed. Read more about GSAs here and here.

Signing a GSA is standard in lending, and more lenders are requiring individuals, not just companies, to sign them. This means that if a company fails, the personal assets of a grantor could also be at risk. Many borrowers don’t realise the full impact of these agreements until it’s too late. If a company defaults on payments to a lender or there is suspicion that business is insolvent, a receiver may be appointed over the grantor’s assets.

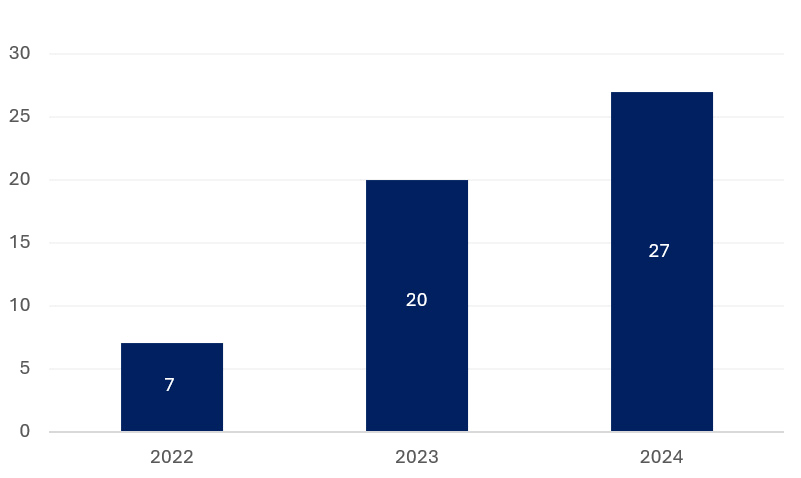

Personal receivership is a growing trend. While this “powerful tool” for a secured creditors has existed for years, economic shifts and increased lending risks have made it more common nowadays.

In 2024, company receiverships increased by 80% compared to 2023, while personal receivership cases rose by 35%. If this trend continues, 2025 could see even more lenders taking action against individuals to recover their funds.

Personal receiverships 2022-2024

Borrowers need to be cautious before signing financial agreements that include personal liability. Business expansion or additional borrowing can seem like a great opportunity until financial trouble strikes. If things go wrong, personal assets like homes, savings, and valuables could be seized to settle debts.

If you have any questions about the role of receivers or would like to discuss a formal appointment, please do not hesitate to contact the team at Waterstone. Get in touch with us at enquiries@waterstone.co.nz or call 0800 256 733.