Statistics indicate a slowing growth rate of registered companies in New Zealand, predicting a potential rise in liquidations.

Recent economic and business data reveal a complex landscape for New Zealand businesses.

Business indexes such as the Performance of Services Index (PSI) and the Performance of Manufacturing Index (PMI) showed significant weaknesses in June 2024 not seen since the Global Financial Crisis (excl. COVID-19 period).

Business conditions are also waning, driven by factors such as inflationary pressures, fluctuating commodity prices, migration, and tight monetary policy. As a result, the above conditions have contributed to a surge in business liquidations over the past few years, as many companies struggle to adapt.

Furthermore, data on company incorporations suggests that the upward trend in liquidations is likely to persist, marking one of the most challenging periods in the past decade, similar to conditions experienced during the 2010s.

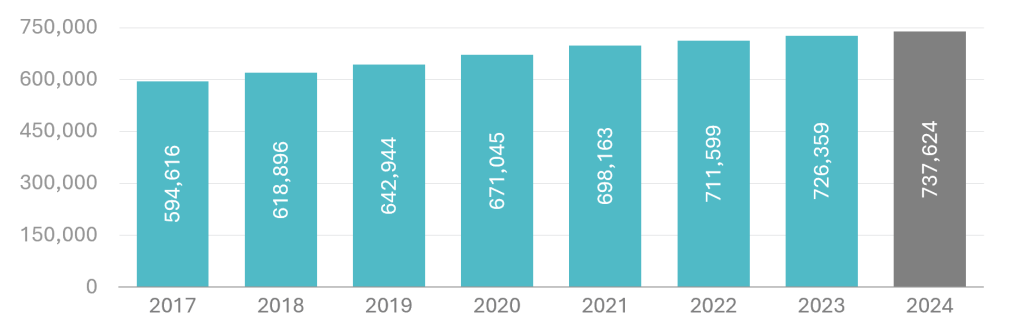

Registered companies in New Zealand

The balance of registered companies (net incorporations) in New Zealand has tripled over the last 20 years, proving the fact that New Zealand is ranked as one of the most attractive places in the world on its ease of doing business.

Balance of registered companies, 2017-2024

Source: Companies Register. *Balance of registered companies are calculated as the difference between total incorporations and total removals.

Historically, the growth of net incorporations serves as a strong indicator of overall economic prosperity and development.

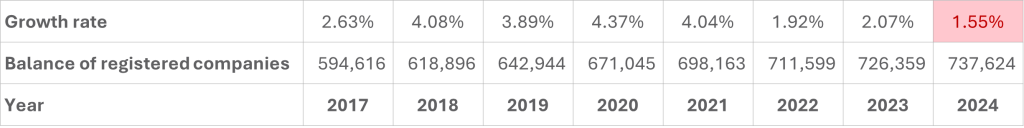

In 2024, the number of net incorporations is projected to reach a historical maximum of 737,500; however, there are signs of coming problems. Although data indicates that new incorporations suggest ongoing economic growth, the underlying concern is the significant slowdown in the pace of net incorporation growth, which has now reached its lowest level in the past eight years.

The pace of net incorporations has been slowing in recent years, falling to 1.55% in 2024, compared to an average growth rate of 3.07%. This deceleration reflects the broader economic challenges and likely signals of coming rise in business liquidations.

Annual growth rate of net incorporations

Source: Waterstone Insolvency.

Liquidations

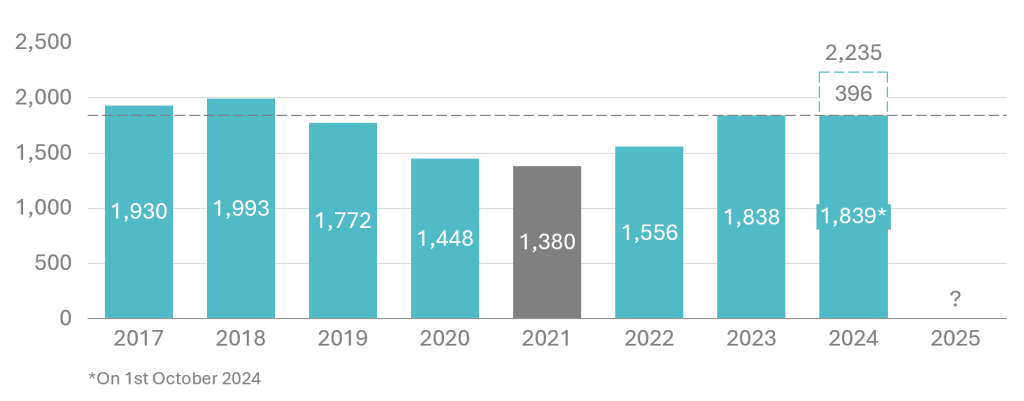

In 2023, the total number of liquidations reached 1,838, which represents a 33% increase compared to 2021, when liquidations were at their lowest in 24 years, totalling 1,380.

The current numbers are concerning, however, as of October 1st, 2024, the total number of liquidations has already reached 1,839, surpassing the maximum of 2023. If this pace continues through the final three months of the year, the total number of liquidations is projected to reach 2,235 by the end of 2024.

Total liquidations, 2017-2024

Source: Waterstone Insolvency.

In response to rising risks to New Zealand’s economy, the Reserve Bank cut the Official Cash Rate (OCR) by 0.25% in August, with another cut of 50 basis points October, leaving it at 4.75 per cent, to support economic activity, despite inflation remaining above the target range of 2-3%.

Monetary easing, combined with supportive fiscal stimulus, aims to alleviate pressures on businesses, potentially improving conditions and stabilizing the economic outlook.

However, if monetary and fiscal stimulus measures fail to significantly boost the growth of new incorporations, and the rate of business growth continues to decline, this could serve as an early warning of further increases in business closures across New Zealand, potentially leading to a new peak in 2025.