The writing has been on the wall for some time now, and as an insolvency firm that has witnessed a sharp increase in all forms of insolvency post-COVID, we’re watching these numbers with particular concern.

What the chart tells us

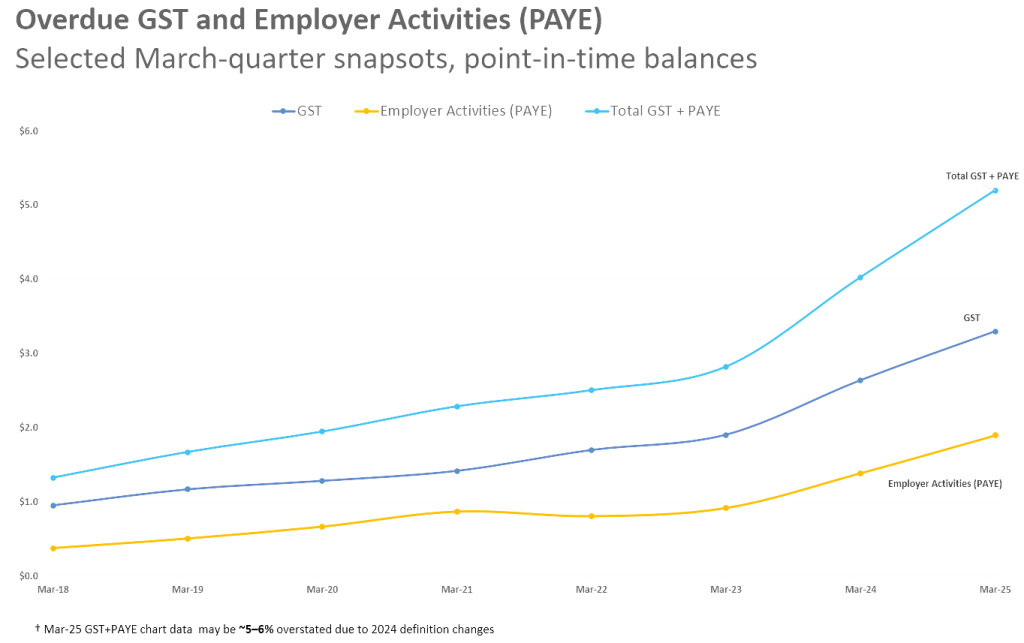

The chart above tracks overdue GST and PAYE debt at each March quarter since 2018, providing a critical snapshot of business health across New Zealand.

What we’re seeing is stark: total overdue GST and PAYE debt has nearly quadrupled from $1.4 billion in March 2018 to $5.2 billion in March 2025. GST debt alone has reached $3.3 billion, while employer activities (PAYE) debt sits at $1.9 billion.

While the IRD notes that some of this increase (approximately 5-6%) stems from definition changes in 2024†, the underlying trend is unmistakable, businesses are struggling to keep up with their tax obligations. More importantly, these March quarter figures serve as a powerful indicator of insolvencies to come.

Why this matters for business survival

These March quarter snapshots serve as a crucial indicator for what’s coming down the pipeline. While debt levels had remained relatively stable between 2018 and 2022 (helped by COVID support measures), the explosion since 2023 is alarming, jumping from around $2.8 billion to $5.2 billion in just two years.

When businesses can’t pay their GST and PAYE, it’s often the canary in the coal mine. They’re using tax money as working capital to keep the doors open. But this strategy has a limited shelf life, especially now that enforcement is intensifying.

The IRD’s latest quarterly report confirms what we’re seeing on the ground: enforcement action is ramping up significantly. IRD-initiated liquidations jumped 68% compared to last year, with 134 liquidations in just the last quarter. Nearly 10,000 customers now have active Section 157 notices in place which are the “last resort” measures where IRD instructs banks and employers to redirect funds directly to them.

The perfect storm

Several factors are converging to create particularly challenging conditions:

- Economic headwinds that have persisted longer than anyone anticipated

- More aggressive collection efforts, with IRD’s high-risk debt team now collecting $3.1 million weekly

- Prosecution numbers more than doubling from last year

The IRD received $116 million in additional funding in Budget 2024 specifically to boost debt collection and compliance activities. They’re building new tools, training specialised teams, and taking an increasingly firm stance on overdue debt.

What this means for business owners

If your business is struggling with tax debt, the message is clear: the grace period is over. With IRD intensifying its focus on GST and employer debt collection, businesses that might have previously flown under the radar are now squarely in the crosshairs.

The trajectory from tax default to insolvency can be swift once enforcement action begins. Business owners need to act now – whether that’s negotiating sustainable payment arrangements, seeking professional advice, or making hard decisions about business viability before those decisions are made for them.

As we’ve seen repeatedly in our practice, the businesses that survive are those that face reality early and take decisive action. Waiting for the Section 157 notice or liquidation proceedings leaves few options on the table.

† March 2025 GST+PAYE chart data may be ~5-6% overstated due to 2024 definition changes