Hospitality Case Studies

Hospitality is an extremely difficult industry to operate in; operators are forced to contend with high capital requirements (mainly for fitout), inconsistent revenue along with high overheads (most notably the company’s rent).

Over the past few years, we have noticed a trend where most hospitality businesses will lease a significant portion of their kitchen equipment and in some cases furniture.

When dealing with a hospitality business, our first position will be to catalogue the assets and determine whether the assets can be ‘sold in-situ.’

An in-situ sale is where a purchaser will purchase the assets of the company in place and are typically conditional on the purchaser negotiating a new lease with the landlord. A successful in-situ sale has the following benefits:

- The sale price of the assets is maximised

- The cost of the liquidation for creditors (most notably the landlord) is minimised)

Unfortunately, an in-situ sale is not always possible, reasons include:

- The landlord wanting to repurpose the premises (for example not lease the business to a hospitality company).

- The landlord requesting lease terms which are either not reasonable, or do not allow for a profitable business to be operated (given the company’s historic turnover).

- The premises can have a reputation for being ‘hard to run’, or simply too large (we have noticed a preference with hospitality operators preferring smaller locations, however, this may be a temporary trend influenced by Covid-19.)

The ideal purchasers we seek are experienced, local hospitality operators who understand the local market and are best placed to take advantage of an in-situ sale.

In the event we are not able to achieve an in-situ sale, we will arrange for the assets to be uplifted and sold by auction; this has the unfortunate effect of a reduced sale price and higher sale costs (Including Auctioneers fees and costs to remove the assets).

All in all, recently due to Covid-19 we have noticed a decrease in interest in Hospitality fitouts and accordingly have noticed it is more difficult (although not impossible) to sell fitouts in-situ.

Assets of a Hospitality business

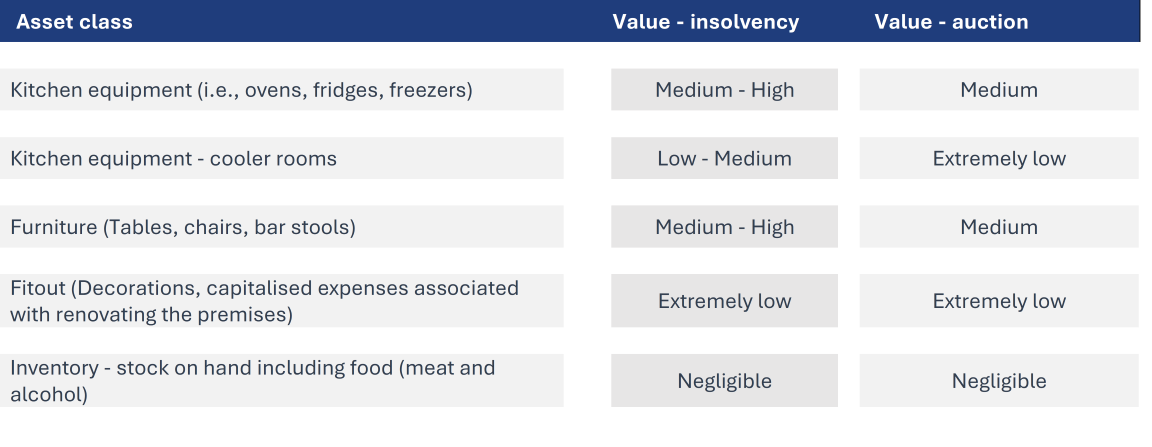

The table below classifies assets we encounter in hospitality businesses and our general expectation of their value. The actual value is largely contingent on the condition, along with market conditions (the sale price of second-hand kitchen equipment and furniture to a lesser extent increased during Covid-19 due to a lack of availability):

Kitchen Equipment including ovens, fridges and freezers are attributed a high value because they are largely interchangeable when a new operator takes over and can easily be sold. These assets can be used if the new operator wishes to enact a new vision or concept with the premises.

Kitchen Equipment – Cooler rooms: The challenge when selling cooler rooms largely depends on whether an in-situ sale is achieved or not. Cooler rooms are usually not economical to sell at auction because the costs to dismantle and transport the asset (requiring qualified personnel) will usually outweigh the prospective sale price at auction.

Furniture: Largely depends on the condition and quality of the equipment, along with the market at the time of the insolvency.

Fitout: Unfortunately, fitout is typically ascribed a value of $0.00 by valuers and potential interested parties. This is because a new operator will typically redo the premises to suit their proposed concept. Furthermore, because it is fixed to the building it is usually not economical to remove and sell at auction.

In some cases, the terms of the company’s lease will mean that the fitout is owned by the landlord.

Inventory: Perishable inventory (including meat, milk, and other food) is generally worth nothing because it will expire during the initial course of the insolvency. Non-perishable inventory (such as alcohol, specifically spirits) can have some value, however the value pales in comparison to the cost to purchase new.

Value of the opportunity

When negotiating an in-situ sale, we can usually get a premium on the Forced liquidation value of the assets (for the kitchen fitout and furniture to a lesser extent) by leveraging the opportunity cost of not buying from the liquidation (in comparison to the cost to establish a new hospitality business).

Simply put, a hospitality operator will incur substantial expenses to establish a ‘fresh’ hospitality business. Purchasing in-situ from a liquidator allows an operator to purchase the fitout at a cheaper price.

The premium we can achieve is largely dependent on:

- The historic performance of the business (from a turnover perspective)

- The lease of the premises (including location and actual lease costs)

- Market conditions (Covid-19 has severely impaired our ability to achieve in-situ sales as experienced operators were not looking to expand)

A hospitality business with poor turnover prior to insolvency and high lease costs will be exceptionally difficult to sell (i.e., a fine dining restaurant), where as a business based out of smaller premises with consistent turnover and lower lease costs (i.e., a café or takeaway based business) will be far easier to sell and accordingly we are much more likely to achieve a premium on the Forced liquidation value.

Successful In-situ Sales

The table below summarises two hospitality insolvencies we have been involved in with successful In-situ sales:

In both cases we either paid the secured creditor or facilitated either their payment or continued leasing of their services:

- For Premium Burgers, the secured creditor had a specific charge over the kitchen equipment; we factored the prospective distribution into the purchase price when dealing with the sale.

- For Good Time Bar, after accounting for the assets owned by the Company, the bar owned very little in the way of realisable assets. We provided schedules of the assets which were secured (and excluded from the sale) and entered a sale based on ‘everything the liquidator has the right to sell.’ We ultimately forwarded the contact details of the purchaser to the secured creditors.